$300 Ctc 2025 Irs - 300 direct deposit payment date 2025, know ctc eligibility & how to, washington — the internal revenue service and the treasury department announced. Ctc for 2025 irs reyna clemmie, biden aims to revive monthly child tax credit payments in 2025 budget plan.

300 direct deposit payment date 2025, know ctc eligibility & how to, washington — the internal revenue service and the treasury department announced.

2025 IRS Penalties for ACA, 1099, & W2 Forms (TY2025), In 2025 the irs is expected to make a $300 direct deposit payout on the 15th of each month to those who are under 6 and those who aged 6 to 17 will expect to receive $250 every month. The ctc is distributed as monthly payments, with the first payment expected in july 2025 (specific date may vary).

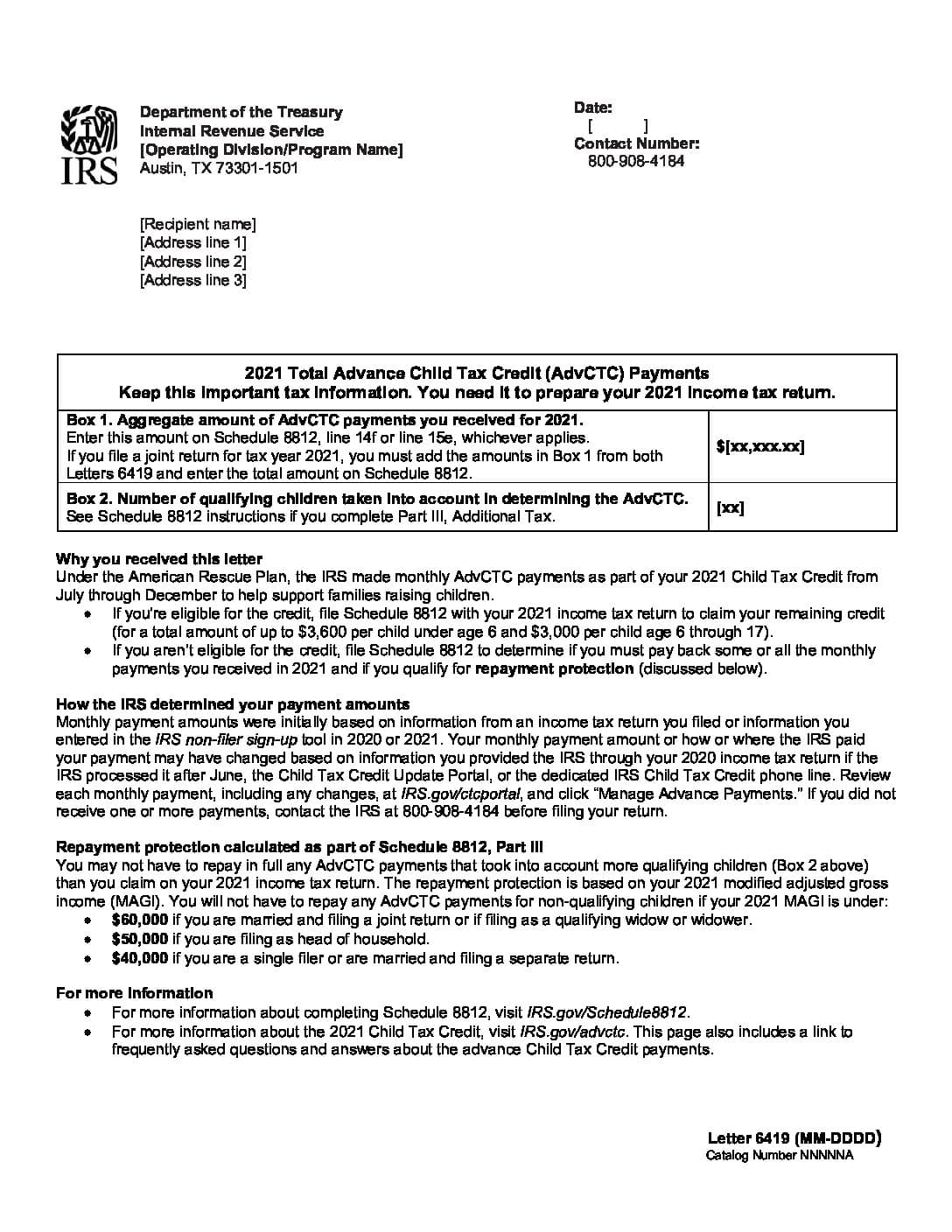

How To Calculate Additional Ctc 2025 Irs Abbye Elspeth, Under the american rescue plan, each payment is up to $300 per month for each child under age 6 and up to $250 per month for each child ages 6 through 17. July 15, august 13, september 15, october 15,.

Ctc IRS, Eligible families will receive a payment of up to $300 per month for each child under age 6 and up to $250 per month for each child age 6 and above. $300 direct deposit child tax credit.

2025 Updates by the IRS Highlights to Know to Maximize Tax Strategy, Under this program, eligible families with children under 6 years old will. June 9, 2025 by editorial board.

2025 IRS TAX REFUND UPDATE Tax Refunds Issued EITC , CTC TAX, In 2025, the irs will make a $300 direct deposit payout on the 15th of each month to those under six. Normally, anyone who receives a payment this month will also receive a payment each.

Irs Ctc Refund Dates 2025 Cyb Laural, This is the amount intended to be deposited every month of the year for that range of families with children of 6 to 17 years old, which is the amount of $250 for each child and. The $300 direct deposit payment date is on the 15th day of every month in 2025.

The ctc amount for each qualifying dependent under 17 years old has increased to $2000, with $1600 potentially refundable.

$300 Ctc 2025 Irs. The payment will be up to $300 per month for each child under age 6 and up to $250 per month for each child age 6 through 17. $300 direct deposit child tax credit.

TAX CREDITS 2025, EITC, CTC, ACTC 2025 IRS TAX REFUND UPDATE YouTube, The child tax credit update portal. Individuals who qualify will receive a monthly payment of $300 for each child under the age of 6, and.

When Will Ctc Refunds Be Issued 2025 Ava Meagan, This irs credit payment is intended to support working families, reduce child poverty, and. This is the amount intended to be deposited every month of the year for that range of families with children of 6 to 17 years old, which is the amount of $250 for each child and.

Irs Ctc 2025 Reyna Clemmie, The child tax credit (ctc) is a federal tax benefit that provides financial. The irs announced that the new monthly child tax credit payments will start july t5, 2021.

Ctc For 2025 Irs Reyna Clemmie, That means eligible taxpayers would be able to. The irs announced that the new monthly child tax credit payments will start july t5, 2021.

Subsequent payments are likely to be on the 15th of each month. To be eligible for the ctc refund, you must meet several criteria: