Bank Stress Test 2025 Scenarios Uk - This year’s supervisory stress test will cover 32 bank holding companies (bhcs). Stress testing of banks an introduction Bank of England, In september 2022, the bank of england (boe) launched its 2022 stress test of the uk banking system, the annual cyclical scenario (acs). Federal reserve is due to release the results of its annual bank health checks on wednesday at 4:30 p.m.

This year’s supervisory stress test will cover 32 bank holding companies (bhcs).

Stress Testing Banks AnalystPrep FRM Part 2 Study Notes, This year’s supervisory stress test will cover 32 bank holding companies (bhcs). As part of this supervision, the bank conducts regular stress testing of uk ccps.

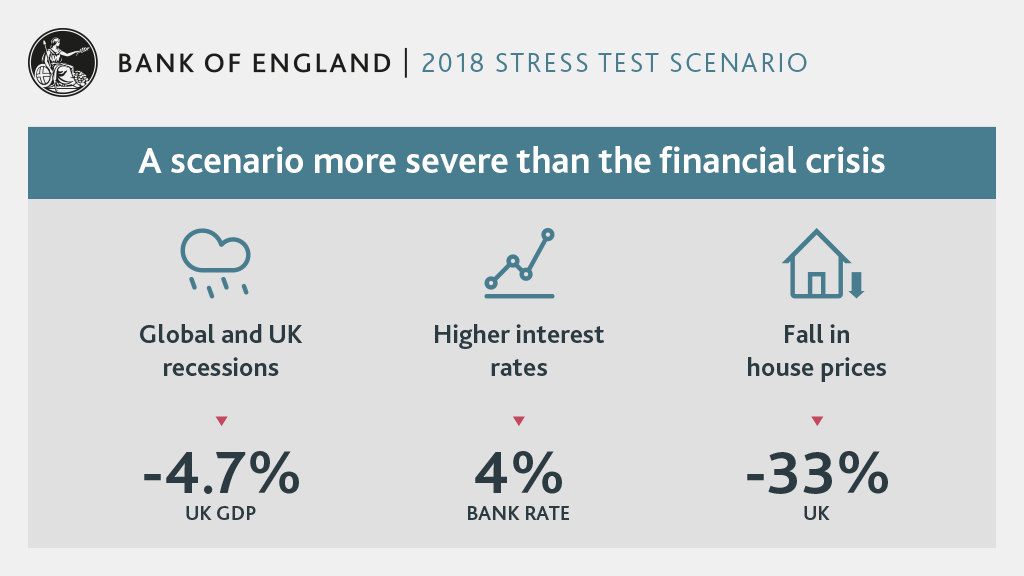

The bank of england kicked off its inaugural stress test of the climate risks facing banks and insurers on tuesday, but its scope was scaled back after participants. As part of this supervision, the bank conducts regular stress testing of uk ccps.

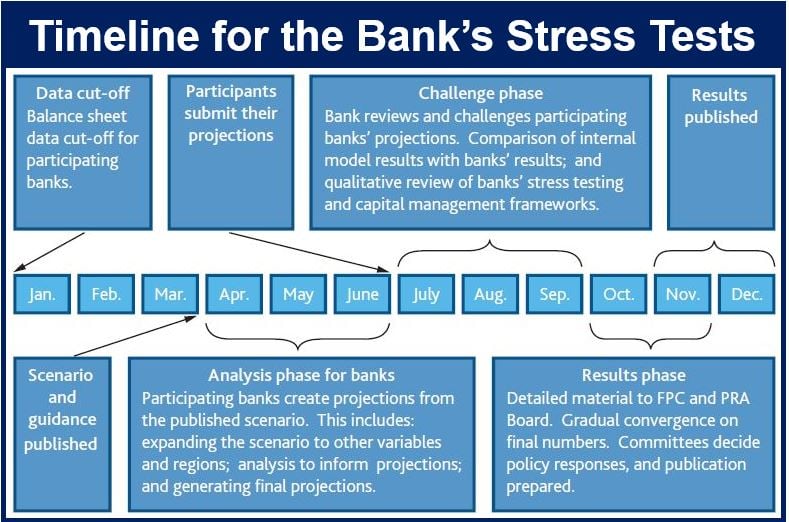

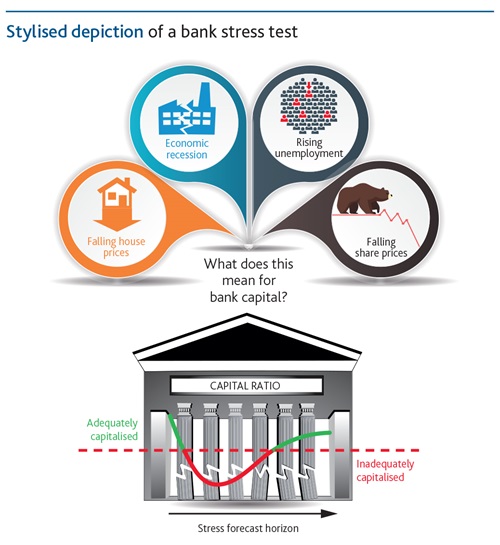

Stress testing banks, The bank of england (boe) has outlined the framework for its 2025 supervisory stress test aimed at assessing the resilience of uk central counterparties. The exercise will test the resilience of the banking system (firms that account.

Stress Test Financial Risk Management An Essential Tool for Building, The exercise will test the resilience of the banking system (firms that account. Federal reserve is due to release the results of its annual bank health checks on wednesday at 4:30 p.m.

Stress test just for larger retail banks, says Bank of England Market, The bank of england kicked off its inaugural stress test of the climate risks facing banks and insurers on tuesday, but its scope was scaled back after participants. The scenarios include hypothetical sets of conditions to.

Stresstest Banken, The stress of a global economic recession will apply to all firms. The bank of england kicked off its inaugural stress test of the climate risks facing banks and insurers on tuesday, but its scope was scaled back after participants.

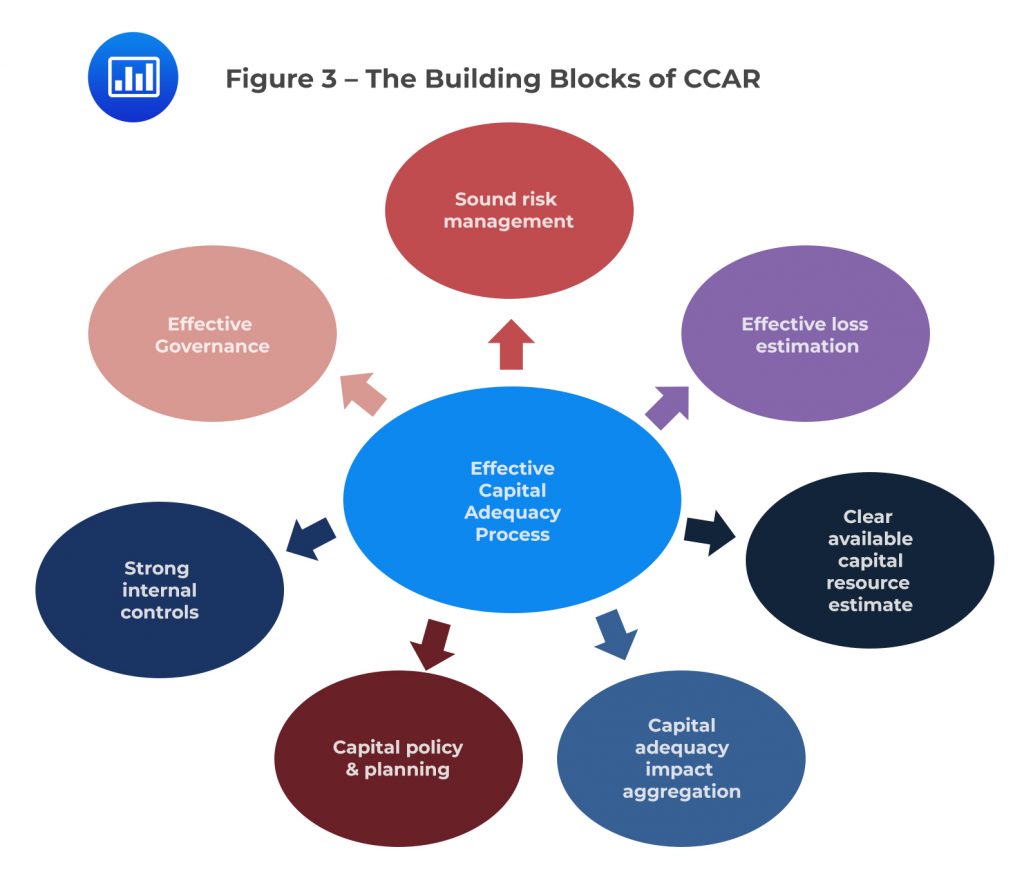

Challenges in Stress Testing and Climate Change Bank Policy Institute, The bank of england (boe)’s annual stress test has been the cornerstone of regulatory stress testing for banks in the uk for the past decade. The move aims to improve understanding of how banks and other financial.

Most European Banks Survive Stress Test WSJ, Having used the solvency stress test in 2021 to test the resilience of the uk banking system against a much more severe evolution of the pandemic and consequent. The bank of england plans to stress test insurers on their exposure to reinsurers through a flurry of corporate pension deals, according to people familiar with.

Bank Stress Test Definition, Example, How it Works?, Federal reserve is due to release the results of its annual bank health checks on wednesday at 4:30 p.m. The bank of england (boe)’s annual stress test has been the cornerstone of regulatory stress testing for banks in the uk for the past decade.

A brief explanation of stress testing in banking under Basel rules with, All 31 big us banks have passed the federal reserve's. Despite the recent deterioration in the uk housing market, we think the doomsday scenario set out.

The bank of england (boe)’s annual stress test has been the cornerstone of regulatory stress testing for banks in the uk for the past decade.

The bank of england (boe) has outlined the framework for its 2025 supervisory stress test aimed at assessing the resilience of uk central counterparties. The bank of england plans to stress test insurers on their exposure to reinsurers through a flurry of corporate pension deals, according to people familiar with.

This year’s supervisory stress test will cover 32 bank holding companies (bhcs).

“this year’s results show that under our stress scenario, large banks would take nearly $685 billion in total hypothetical losses, yet still have considerably more.